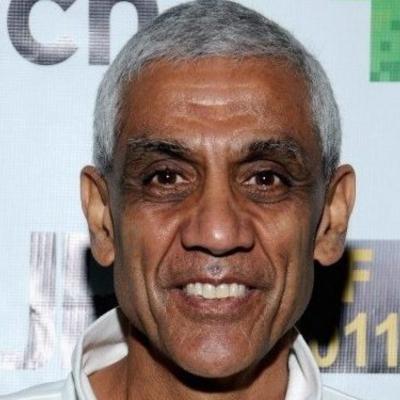

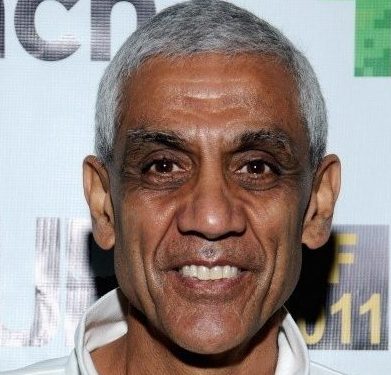

Vinod Khosla at a Glance

- Categories: Business > Billionaires, Business

- Net Worth: $6 Billion

- Birthdate: Jan 28, 1955 (69 years old)

- Birthplace: Delhi

- Gender: Male

- Profession: Venture capitalist, Entrepreneur, Businessperson

- Nationality: United States of America

Vinod Khosla: From Sun Microsystems Co-founder to Venture Capital Titan

Introduction: A Visionary in Technology and Venture Capital

Vinod Khosla is a prominent figure in the worlds of technology and venture capital. His career spans decades, marked by significant contributions to the tech industry and a knack for identifying and nurturing groundbreaking innovations. From co-founding Sun Microsystems to establishing Khosla Ventures, Khosla’s influence is undeniable. This article delves into the life, career, and controversies surrounding this influential entrepreneur, exploring his net worth, early life, ventures, and lasting impact.

What is Vinod Khosla’s Net Worth?

Vinod Khosla has amassed a substantial fortune throughout his career. His net worth, as of the latest estimates, is approximately $6 billion. This wealth is the result of his successful ventures in the technology sector and his astute investments through Khosla Ventures. The firm’s diverse portfolio, encompassing sectors from sustainable energy to artificial intelligence, has significantly contributed to his financial standing.

Early Life and Education: The Genesis of an Entrepreneur

Vinod Khosla’s journey began on January 28, 1955, in New Delhi, India. His early life provided the foundation for his future success. Khosla’s father, an officer in the Indian Army, instilled a sense of discipline and ambition. Despite initially considering a career in the military, Khosla’s interests shifted toward technology after reading about the founding of Intel. This pivotal moment sparked a lifelong passion for innovation.

- Education: Khosla pursued his education with dedication.

- IIT Delhi: He earned a bachelor’s degree in electrical engineering from IIT Delhi in 1976. During his time there, he demonstrated leadership and initiative by starting a computer programming club and managing the computer center during a staff strike.

- Carnegie Mellon: He then earned a master’s degree in biomedical engineering from Carnegie Mellon University.

- Stanford University: Despite initial rejections, Khosla persisted and earned an MBA from Stanford University’s Graduate School of Business in 1980.

These educational experiences equipped him with the technical knowledge and business acumen necessary to thrive in the rapidly evolving tech landscape.

Sun Microsystems: Pioneering the Dot-com Era

After completing his MBA, Khosla’s career took a significant turn. He became the Chief Financial Officer of Daisy Systems, a company focused on computer-aided engineering. However, his vision extended beyond this role. In 1982, he co-founded Sun Microsystems with Scott McNealy, Andy Bechtolsheim, and Bill Joy. The name “Sun” was derived from the “Stanford University Network,” a workstation developed by Bechtolsheim. Khosla served as CEO during the company’s formative years.

- Key Achievements:

- Early Success: Sun Microsystems achieved profitability within its first year.

- Innovation: The company was at the forefront of computer technology, developing innovative hardware and software.

- Growth: Sun Microsystems thrived during the dot-com boom, with its stock reaching over $100 per share in 2001.

- Transition: Khosla left Sun Microsystems in 1984 to pursue venture capitalism, with Scott McNealy taking over as CEO.

- Acquisition: In 2010, Sun Microsystems was acquired by Oracle Corporation for $7.4 billion, marking the end of an era.

Sun Microsystems played a crucial role in shaping the technology industry, contributing to the rise of the internet and the dot-com boom.

Khosla Ventures: Investing in the Future

In 1986, Khosla joined Kleiner Perkins, a prominent venture capital firm. He managed investments in various technology companies, honing his skills in identifying promising startups and technologies. In 2004, he transitioned to a part-time role at Kleiner Perkins to spend more time with his family before eventually leaving to establish Khosla Ventures. This firm became the cornerstone of his venture capital career. Khosla Ventures provides venture assistance and strategic advice to entrepreneurs focused on breakthrough technologies. The firm manages over $15 billion in assets and focuses on sectors such as:

- Semiconductors

- Robotics

- Sustainable Energy

- Artificial Intelligence

- Biotechnology

Khosla Ventures has invested in numerous successful companies, including:

- QuantumScape (solid-state batteries)

- LanzaTech (carbon recycling technology)

- Impossible Foods (plant-based meat products)

Vinod Khosla’s venture capital efforts reflect a commitment to using technology to address significant global challenges. His investments demonstrate a forward-thinking approach, focusing on innovations that have the potential to reshape industries and improve society.

The Martin’s Beach Controversy: A Battle Over Public Access

While Khosla’s business achievements are widely recognized, he is also known for the controversial dispute over access to Martin’s Beach in California. In 2008, Khosla purchased 53 acres of land adjacent to the beach for $32 million. This property included the only land-based access trail to the beach.

- Dispute:

- Public Access: Prior owners of the property had allowed public access to the beach.

- Gate Closure: In 2010, Khosla began locking the gate to the access trail, effectively blocking public access to Martin’s Beach.

- Legal Battles: This action led to a lengthy legal battle, with the state of California suing Khosla on behalf of the California State Lands Commission and the California Coastal Commission.

- Ongoing Status: The legal dispute remains unresolved, highlighting the complex interplay between private property rights and public access to natural resources.

The Martin’s Beach controversy underscores the challenges of balancing private interests with public rights, making it a prominent case in discussions about coastal access and property ownership.

Personal Life and Philanthropic Endeavors

Vinod Khosla’s personal life is marked by his long-standing marriage to Neeru, whom he wed in 1980. They have four children: Vani, Nina, Neal, and Anu. Neeru Khosla is the co-founder of the CK-12 Foundation, a non-profit organization focused on providing free, high-quality STEM education resources. Khosla’s philanthropic activities extend beyond his family’s foundation.

- DonorsChoose: He served as an honorary chair of the advisory board for DonorsChoose in the San Francisco Bay Area.

- Wikimedia Foundation: In 2008, Vinod and Neeru donated $500,000 to the Wikimedia Foundation.

- COVID-19 Relief: During the COVID-19 pandemic, Khosla pledged to fund hospitals in India to import oxygen and supplies.

His philanthropic efforts reflect a commitment to education, community development, and global health.

Khosla has received several accolades for his achievements, including the American Academy of Achievement’s Golden Plate Award in 2000 and the EY Entrepreneur of the Year award for Northern California in 2007. He has also served as an advisor and board member for various institutions, including Carnegie Mellon University and the University of California, Berkeley’s Blum Center for Developing Economies.

Legacy and Influence: Shaping Technology and Society

Vinod Khosla’s legacy is multifaceted, encompassing significant contributions to the technology industry, successful venture capital investments, and a notable presence in public discourse. His co-founding of Sun Microsystems and his leadership at Khosla Ventures have made a lasting impact on the tech landscape. Khosla’s investment philosophy emphasizes innovation and the potential of technology to solve significant societal challenges.

- Key Takeaways:

- Tech Pioneer: Khosla played a crucial role in the development of the IT industry.

- Venture Capital Leader: His ventures have shaped the direction of innovation in multiple fields.

- Philanthropic Impact: His support for education and global health initiatives.

- Controversial Figure: The Martin’s Beach controversy highlights the complexities of property rights and public access.

Vinod Khosla’s career serves as an example of entrepreneurship, innovation, and the influence of technology on society. His story continues to evolve, making him a significant figure in the contemporary world.

Araya Diaz/Getty Images