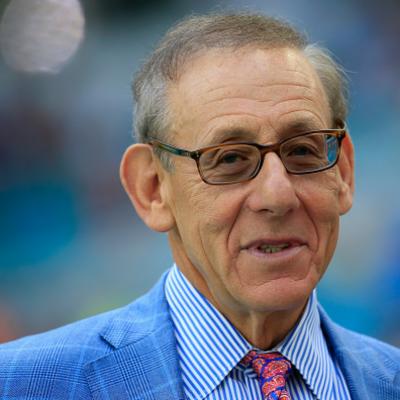

Stephen Ross at a Glance

- Categories: Business, Business > Executives

- Net Worth: $10 Billion

- Birthdate: May 10, 1940 (84 years old)

- Birthplace: Boston

- Gender: Male

- Profession: Economist

- Nationality: United States of America

What is Stephen Ross’s Net Worth? A Deep Dive into the Billionaire’s Empire

Stephen Ross is a prominent figure in the worlds of real estate, sports, and philanthropy, boasting an impressive net worth that reflects his diverse and successful ventures. This article delves into the life and career of Stephen Ross, exploring his financial achievements, business strategies, and significant contributions across various industries.

Early Life and Education

Stephen Ross’s journey began on May 10, 1940, in Detroit, Michigan, into a Jewish family. His early life in Detroit laid the foundation for his future success. After attending Mumford High School in Detroit, he moved to Florida, where he graduated from Miami Beach Senior High School. This transition exposed him to different environments and broadened his perspectives.

His pursuit of higher education took him to the University of Florida for two years before he transferred to the University of Michigan, his home state’s prestigious institution. He earned a Bachelor of Business Administration (BBA) in 1962. Building upon this foundation, Ross sought further academic achievements, earning a Juris Doctor (JD) from Wayne State University in 1965, followed by a Master of Laws (LLM) in taxation from the New York University School of Law in 1966. His graduate studies were partially funded by a loan from his uncle, Max Fisher, a well-known businessman and philanthropist, highlighting the early influences that shaped his career.

Career Beginnings

Stephen Ross started his professional career as a tax attorney at Coopers & Lybrand in Detroit, gaining valuable experience in financial and legal matters. In 1968, he relocated to New York City and became an assistant vice president in the real estate subsidiary of Laird, expanding his focus to real estate. His career trajectory continued with a role in the corporate finance department of Bear Stearns. However, he was fired in 1972 after disagreements with a superior, which led to a pivotal turning point in his career.

Without a job, Ross relied on financial support from his mother. He leveraged his understanding of federal tax law to structure deals for wealthy investors. His success in this venture was remarkable, earning him approximately $150,000 in his first year. This experience was crucial, providing him with the capital and expertise to launch his own real estate development firm, The Related Companies.

The Related Companies: Real Estate Dominance

In 1972, Stephen Ross founded The Related Companies, a real estate development firm that would become one of the largest and most influential in the United States. Initially, the company specialized in housing, constructing numerous subsidized low- and moderate-income apartments across the country. This focus on affordable housing provided a solid base for future expansion.

By the 1980s, Ross expanded the company’s portfolio to include higher-profile and luxury projects. His vision and strategic decisions led to the development of iconic properties. In the 1990s, he partnered with architect Robert A. M. Stern to design the Chatham, located on the corner of 65th Street and Third Avenue in New York City. The Related Companies soon embarked on other significant projects, including Willets Point, an industrial area near Citi Field in Queens, and the New York Coliseum, a convention center in Manhattan.

Among the firm’s most famous projects are the Deutsche Bank Center, a mixed-use building on Columbus Circle in Manhattan, which opened in 2004, and Hudson Yards, a massive 28-acre development that began construction in 2012. Hudson Yards stands as the largest and most expensive real estate project in the nation, showcasing the company’s ambition and capacity.

Today, The Related Companies is headquartered in New York City and has expanded its operations to other major US cities, including Boston, Washington, DC, Chicago, Dallas, and Los Angeles. The company has also established offices and real estate developments internationally in London and Abu Dhabi.

With approximately 4,000 employees, The Related Companies manages a real estate portfolio valued at over $60 billion and is the largest owner of luxury residential rental properties in the United States. In 2012, Ross assumed the role of chairman, while Jeff Blau became CEO, ensuring a seamless transition of leadership. Related continued to build its portfolio with the completion of the Abington House, a rental apartment property on Manhattan’s High Line, and the Emerson, an affordable housing community for older adults. In 2017, the company completed the 690-unit Brickell Heights condo development in Miami, Florida. In 2023, Related opened the 294-unit luxury rental condo the Row Fulton Market in Chicago, further solidifying its presence in the real estate market.

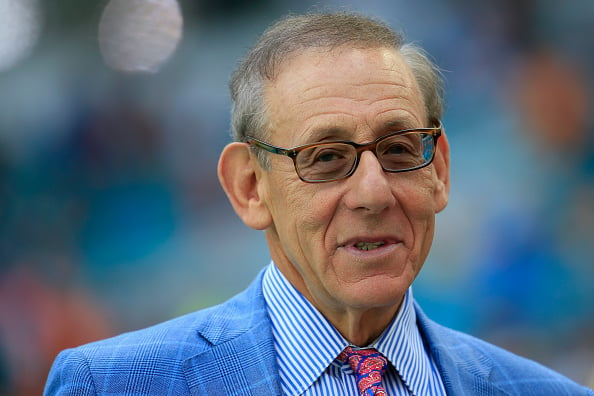

Getty Images

Miami Dolphins: Sports Team Ownership and Controversies

Stephen Ross’s business interests extend beyond real estate to the world of professional sports. In early 2008, he acquired 50% of the NFL’s Miami Dolphins, along with Dolphin Stadium and the surrounding land, from the existing owner Wayne Huizenga. He increased his stake to 95% in early 2009, becoming the majority owner of both the Dolphins franchise and the stadium, marking a significant expansion of his business empire.

Since acquiring the Dolphins, Ross has brought in several celebrities as minority owners, including Marc Anthony, Gloria Estefan, Tony Chesta, and Venus and Serena Williams. These partnerships enhanced the team’s profile and expanded its fan base.

In the summer of 2016, the Dolphins’ home stadium was renamed Hard Rock Stadium after its naming rights were sold to Hard Rock Cafe. This partnership not only generated additional revenue but also improved the stadium’s reputation.

However, Ross’s ownership of the Miami Dolphins has also faced controversy. In early 2022, he and the Dolphins were cited in a federal class-action lawsuit initiated by former Dolphins head coach Brian Flores. Flores alleged that Ross offered him a $100,000 bonus for every game he lost during the 2019 season. Following a six-month independent investigation, the NFL found that the Dolphins violated the league’s anti-tampering policy on three separate occasions by having unauthorized conversations with quarterback Tom Brady and New Orleans Saints coach Sean Payton.

As a result, the NFL penalized the Dolphins by stripping them of their 2023 first-round draft pick and a 2024 third-round draft pick. Additionally, Ross was fined $1.5 million, suspended through October 2022, and removed from all league committees indefinitely. These sanctions underscored the importance of adhering to league regulations and maintaining fair play.

Other Holdings and Ventures

Beyond the Miami Dolphins and The Related Companies, Stephen Ross has invested in various other ventures. He owns the Miami International Autodrome, a temporary circuit that hosts the Miami Grand Prix around Hard Rock Stadium. The circuit has an exclusive agreement to host the Miami Grand Prix through the 2032 season, further solidifying Ross’s presence in the sports and entertainment industries. Another major venture for Ross is RSE Ventures, a private investment firm co-founded with Matt Higgins. This firm builds, owns, and operates diverse companies, including the sports media and events companies Thuzio and Relevant, demonstrating Ross’s involvement in multiple sectors.

Philanthropy: Giving Back to the Community

Stephen Ross is also known for his significant philanthropic contributions. He is a major benefactor to his alma mater, the University of Michigan. In 2004, he donated $100 million to the school, followed by a $200 million donation in 2013, which was distributed among the Ross School of Business and the university’s athletic department. Over the years, he has continued to make substantial donations to the university, supporting educational initiatives and programs. In addition to his contributions to the University of Michigan, Ross holds positions on the boards of trustees of several prominent organizations. He is a member of the boards of the Solomon R. Guggenheim Foundation, New York Presbyterian Hospital, and the Urban Land Institute. He also serves as a director of the Jackie Robinson Foundation and the World Resources Institute, demonstrating his dedication to various causes.

Politics and Political Affiliations

Stephen Ross has been involved in politics, particularly through his financial contributions. In 2012, he was a significant contributor to the presidential campaign of Republican Mitt Romney. He also supported the campaign of Donald Trump, reflecting his interest in and support for political activities.

Personal Life

Stephen Ross’s personal life includes his family. He has two children from his first marriage. He also has two stepchildren from his second marriage to Kara Gaffney. The couple divorced in 2021 after 18 years of marriage.

Ross maintains a high standard of living, residing in the Deutsche Bank Center in Manhattan, a building developed by The Related Companies. In addition, he owns an 11,000-square-foot oceanfront mansion in Palm Beach, Florida, providing him with luxurious residential options.

/**/