Michael Milken at a Glance

- Categories: Business, Business > Wall Street

- Net Worth: $6 Billion

- Birthdate: Jul 4, 1946 (78 years old)

- Birthplace: Encino

- Gender: Male

- Profession: Entrepreneur, Businessperson, Banker, Financier

- Nationality: United States of America

Michael Milken’s Net Worth: A Comprehensive Look at the Financier’s Life and Legacy

Michael Milken is a name synonymous with both financial innovation and controversy. As an American financier and philanthropist, he has amassed a significant fortune and wielded considerable influence in the world of finance. This article delves into Michael Milken’s net worth, exploring his career, the scandals that marked his tenure, his philanthropic contributions, and the enduring legacy he leaves behind.

Early Life and Education

Michael Milken’s journey began on July 4, 1946, in Encino, California. Born into a middle-class Jewish family, his upbringing provided the foundation for his future endeavors. Milken’s early life included attending Birmingham High School, where he demonstrated leadership skills as the head of the cheerleading squad. He pursued higher education at the University of California, Berkeley, earning a bachelor of science degree. He later obtained his MBA from the prestigious Wharton School of the University of Pennsylvania.

Career in Finance and High-Yield Bonds

Milken’s career in finance took off after securing a summer job at Drexel Harriman Ripley through connections made at Wharton. There, he became director of low-grade bond research, with trading privileges. In 1973, the merger between Drexel and Burnham & Company formed Drexel Burnham, with Milken leading high-yield bond operations. His innovative approach to finance, particularly in the realm of high-yield bonds (often called “junk bonds”), would revolutionize the financial landscape.

He saw the potential of these bonds, which offered higher returns to compensate for their lower credit ratings. Milken’s high-yield bond department quickly achieved a 100% return on investment, becoming a cornerstone of Drexel Burnham’s success. By the mid-1980s, Milken had cultivated an extensive network of high-yield bond buyers, enabling him to raise substantial capital quickly. This financial power fueled leveraged buyouts and corporate restructuring during this period. In his peak earning years from 1983 to 1987, Milken earned over $1 billion.

The Rise and Fall: The “Junk Bond King” Era

Milken’s expertise in high-yield bonds earned him the moniker “Junk Bond King.” His activities significantly impacted corporate finance, providing capital for businesses that might not have had access to traditional financing. He was instrumental in financing the growth of numerous companies, including those in emerging industries. However, this era also sowed the seeds of controversy.

Milken’s methods were often aggressive and pushed the boundaries of financial regulations. The high-yield bond market’s growth, while beneficial to many companies, also introduced risks. The rise of leveraged buyouts, fueled by Milken’s financing, led to concerns about corporate debt levels and potential instability in the financial system. During this period, his compensation reached unprecedented levels, with earnings of $550 million in 1987 alone, equivalent to approximately $1.5 billion today.

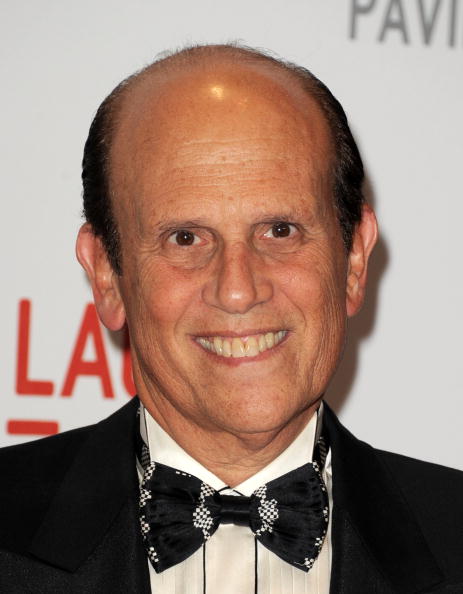

(Photo by Alberto E. Rodriguez/Getty Images)

Criminal Charges and the Securities Fraud Scandal

The rapid expansion of the high-yield bond market, along with Milken’s practices, drew scrutiny from the Securities and Exchange Commission (SEC). Investigations began in 1979, focusing on unethical and illegal activities within the high-yield bond department. Milken’s alleged disregard for securities laws led to accusations of insider trading, stock manipulation, and fraud. The investigation gained momentum when Ivan Boesky, a stock trader, pleaded guilty to securities fraud and implicated Milken.

The SEC initiated a probe of Drexel Burnham, particularly Milken’s high-yield bond operations. Despite his initial insistence that he and Drexel had not acted illegally, pressure mounted. Drexel faced the threat of indictment, prompting the firm’s management to negotiate a plea bargain. A limited partnership, MacPherson Partners, was found to have suspicious activity, involving violations of fiduciary duty. Drexel pleaded guilty to six counts of stock parking and stock manipulation in 1988. Milken resigned from Drexel and established the International Capital Access Group.

In 1989, a federal grand jury indicted Milken on 98 counts of fraud and racketeering. In April 1990, he pleaded guilty to six counts of tax and securities violations. As part of the plea agreement, Milken agreed to pay $200 million in fines and $400 million in civil settlements. He received a lifetime ban from the securities industry and was sentenced to ten years in prison, though this was later reduced to two years due to his cooperation with authorities. He served 22 months.

Kevin Winter / Getty Images

Philanthropic Work and Contributions

Following his release from prison, Milken focused significantly on philanthropy. Soon after his release in 1993, he was diagnosed with prostate cancer, which became a catalyst for his charitable work. He established the Prostate Cancer Foundation to raise funds for research into the disease. The Foundation has partnered with Major League Baseball’s Home Run Challenge to boost awareness and research.

Milken’s philanthropic work extends to other areas as well. He established the Milken Family Foundation and chairs the Milken Institute. Through the Milken Institute, he founded FasterCures, a think tank dedicated to accelerating research into deadly diseases. Milken and his family have contributed an estimated $1.5 billion to various charities. His commitment to public health is recognized through the renaming of George Washington University’s school of public health after him.

Personal Life and Real Estate Holdings

Michael Milken married Lori Anne Hackel in 1968, and they have three children. Milken is known for following a healthy, vegetarian-like diet, a lifestyle reflected in his co-authorship of a vegan cookbook. He and his wife continue to reside in the same home they purchased in 1977 for $587,500. The property is a 1.1-acre estate featuring a 7,000-square-foot, seven-bedroom home, a tennis court, a pool, and a large lawn.

Milken’s children have been involved in significant real estate transactions. In January 2009, his son Gregory purchased a home in Pacific Palisades, Los Angeles, for $14.5 million. Gregory listed the home for sale in February 2023 for $64 million. However, as of the writing of this article, a buyer has not been found.

/**/

The Lasting Legacy of Michael Milken

Michael Milken’s story is a complex one. His career saw the transformation of finance and the evolution of high-yield bonds. He played a central role in the growth of many businesses and brought a new paradigm to corporate finance. However, his legacy is also marked by scandal and controversy. The securities fraud case and subsequent prison sentence have forever shaped how his career is viewed. Despite his past, Milken’s contributions to philanthropy are undeniable. His focus on cancer research and other causes demonstrates a commitment to improving the lives of others. His story reflects the intricate relationship between innovation, ambition, and ethical behavior.

In conclusion, Michael Milken’s life and career are a study in contrasts. While he reached the heights of financial success, his actions led to severe consequences. Today, his net worth of $6 billion reflects both his accomplishments and the lasting impact of his decisions. His legacy is one of innovation, controversy, and philanthropy, making him one of the most significant and debated figures in modern financial history.