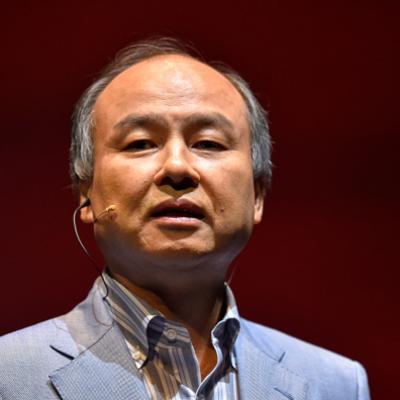

Masayoshi Son at a Glance

- Categories: Business > Billionaires, Business

- Net Worth: $13 Billion

- Birthdate: Aug 11, 1957 (66 years old)

- Birthplace: Tosu

- Gender: Male

- Profession: Entrepreneur, Businessperson

- Nationality: Japan

Masayoshi Son’s Net Worth: A Deep Dive into the Billionaire’s Fortune and Ventures

Introduction: The Man Behind SoftBank

Masayoshi Son is a name synonymous with technological innovation and ambitious investment strategies. As the founder and CEO of SoftBank, a multinational conglomerate, Son has become a prominent figure in the global business landscape. This article delves into the specifics of Masayoshi Son’s net worth, exploring his early life, career trajectory, and the diverse investments that have solidified his position as one of the wealthiest individuals in the world. We’ll examine the key components of his financial empire, including SoftBank’s ventures in telecommunications, technology, and renewable energy. Furthermore, this comprehensive analysis will provide insight into the strategic acquisitions, such as Arm Holdings, and the Vision Fund’s investments in cutting-edge technologies.

Masayoshi Son’s Net Worth: A Financial Snapshot

As of late 2024, Masayoshi Son’s net worth is estimated to be around $13 billion. This substantial wealth is a direct result of his visionary leadership and strategic investments through SoftBank. His 25% ownership of SoftBank, coupled with astute investment decisions, has allowed him to navigate the volatile tech market and maintain a prominent position among the world’s richest individuals. While his journey has included setbacks, such as significant losses during the dot-com crash, Son’s ability to adapt and innovate has been crucial to his continued success. Notably, Son has used a significant portion of his SoftBank shares as collateral against loans, a common practice among high-net-worth individuals. This financial strategy allows access to capital for investments, but it also introduces a level of risk that is carefully managed.

Early Life and Career: From Humble Beginnings to Tech Titan

Masayoshi Son’s journey to becoming a tech titan began in Tosu, Saga, Japan, on August 11, 1957. Born to Korean parents who had naturalized as Japanese citizens (Zainichi Korean), Son’s early life was marked by modest circumstances. Growing up in a family of farmers, he learned the value of hard work and perseverance from a young age. His brother, Taizo Son, also made a name for himself as a successful entrepreneur and investor. Son’s educational pursuits led him to the United States, where he studied at the University of California, Berkeley. His entrepreneurial spirit was evident even during his college years, as he developed an electronic translator that he sold to Sharp Corporation for a significant profit. He also imported used video game machines and installed them in locations around campus.

After graduating from Berkeley with a degree in economics, Son returned to Japan and founded SoftBank in 1981. His decision to use his Korean surname, rather than the adopted Japanese surname of his family, reflected his desire to be a role model and a symbol of pride for other ethnically Korean individuals in Japan, a bold move that showed his values beyond business.

SoftBank: The Engine of Son’s Empire

SoftBank is the cornerstone of Masayoshi Son’s financial empire. Founded at the age of 24 in Tokyo, it initially served as a software distributor. The company quickly expanded into publishing, launching magazines covering personal computers and software. SoftBank went public in 1994 with a valuation of $3 billion, marking a significant milestone. Son aggressively expanded SoftBank through strategic acquisitions and investments. He acquired the media conglomerate Ziff Davis and the computer expo COMDEX, positioning SoftBank at the forefront of the burgeoning tech industry. A pivotal move was SoftBank’s investment in early internet services and companies. Son formed a joint venture with Yahoo! and invested in the Chinese tech giant Alibaba, which would later generate a substantial return on investment.

In October 1999, SoftBank transitioned into a holding company, allowing for a more diversified investment strategy. SoftBank’s investments span sectors such as telecommunications, e-commerce, marketing, and information technology. The company operates the Vision Fund, the world’s largest technology-focused venture capital fund. SoftBank is currently the second-largest publicly traded company in Japan, demonstrating its significant influence in the market.

Arm Holdings: A Strategic Acquisition

In 2016, SoftBank made a landmark acquisition, purchasing the British semiconductor and software design company Arm Holdings for $34 billion. This was the largest acquisition of a European technology company at the time. Arm specializes in designing CPUs and other chips used in a wide range of devices, from smartphones to computers. The company is known for its energy-efficient processor designs, which are critical in mobile devices. Beyond its core business, Arm also produces AI accelerator chips. In September 2020, a deal was reached for the U.S.-based chipmaker Nvidia to acquire Arm from SoftBank for $40 billion. As part of this transaction, SoftBank would acquire a 10% stake in Nvidia, reflecting a strategic alignment of interests.

The Vision Fund: Investing in the Future

SoftBank’s Vision Fund is a $100 billion venture capital fund focused on investing in emerging technologies. The fund’s investments include artificial intelligence, robotics, and the Internet of Things. The Vision Fund invests in companies seeking to transform sectors like transportation, real estate, and retail. Son aims to launch new funds every few years, each valued at $100 billion, with an objective of deploying approximately $50 billion annually into startups. Companies in the Vision Fund portfolio include Didi, Grab, Paytm, Uber, DoorDash, Coupang, and WeWork. The fund’s investments reflect a long-term perspective on disruptive technologies that have the potential to reshape various aspects of modern life.

Other Investments and Ventures

In addition to SoftBank’s core businesses and the Vision Fund, Son has invested in a variety of other ventures. He holds a 76% stake in Sprint, which has grown to approximately 84% through SoftBank’s further acquisitions. Furthermore, Son is deeply involved in renewable energy, including a significant investment in the largest solar project following the Fukushima Daiichi nuclear disaster in 2011. This project is part of Saudi Arabia’s Vision 2030 plan, highlighting Son’s commitment to sustainable energy solutions. Through SoftBank, Son also owns the Fukuoka SoftBank Hawks, a professional Japanese baseball team. This ownership shows Son’s diversified interests beyond technology and investment.

Personal Life and Philanthropy

Masayoshi Son’s personal life includes his marriage to Masami Ohno, whom he met while attending the University of California, Berkeley. The couple has two daughters and resides in a three-story mansion in Tokyo, complete with a cutting-edge, temperature-controlled golf course. Son also owns a home in Woodside, California, valued at $117 million. In addition to his business ventures, Son has also made investments in real estate, including the purchase of the Tiffany Building in Ginza for $326 million. While his primary focus remains on business innovation and investment, Son and SoftBank also support a range of philanthropic activities.

Conclusion: Son’s Enduring Legacy

Masayoshi Son’s journey exemplifies the qualities of a visionary entrepreneur. From his modest beginnings to building a multi-billion dollar empire, he has consistently demonstrated an ability to identify and capitalize on emerging opportunities. His strategic investments, leadership of SoftBank, and the Vision Fund’s impact have shaped the tech and investment landscapes. As he continues to innovate and invest in cutting-edge technologies, Masayoshi Son’s legacy will continue to evolve, leaving a lasting imprint on the global economy and the future of technology.