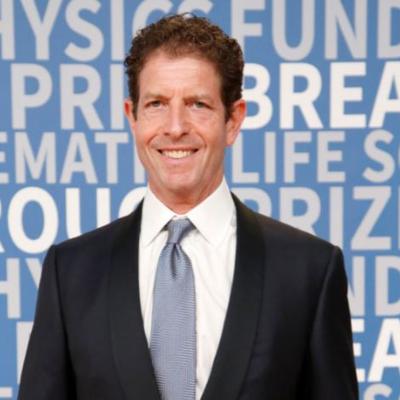

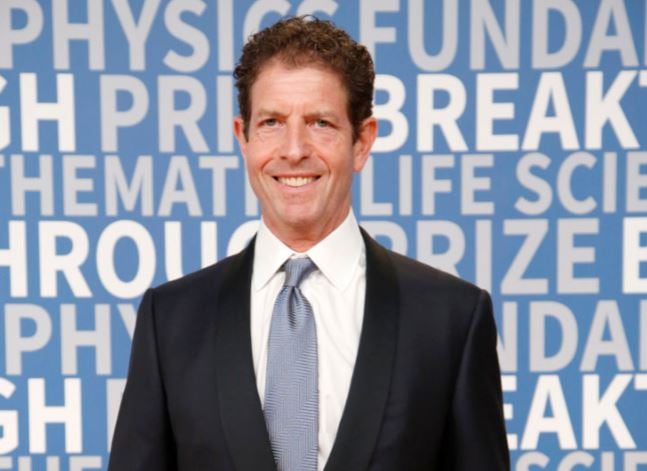

Daniel Och at a Glance

- Categories: Business, Business > Wall Street

- Net Worth: $5 Billion

- Birthdate: 1961 (63 years old)

- Gender: Male

Daniel Och’s Net Worth: A Deep Dive into the Billionaire’s Wealth

Early Life and Career at Goldman Sachs

Daniel Och, a prominent American businessman, has amassed a substantial fortune, with a net worth estimated at $5 billion. This wealth is primarily attributed to his successful career in the financial industry, most notably as the CEO of Och-Ziff Capital Management, now known as Sculptor Capital Management, a significant player in the global hedge fund and alternative asset management arena. Och’s journey to financial success began with a solid educational foundation. He earned a Bachelor of Science in Economics from the prestigious Wharton School of the University of Pennsylvania, setting the stage for his future endeavors.

In 1982, Och embarked on his professional journey at Goldman Sachs, a leading investment banking firm. He started in the Risk Arbitrage Department, honing his skills and gaining valuable experience in the financial markets. Over the next decade, Och rapidly ascended the ranks, demonstrating exceptional talent and leadership. He eventually became the Head of Proprietary Trading in the Equities Division and later, Co-Head of U.S. Equities Trading. This period at Goldman Sachs was instrumental in shaping his understanding of market dynamics and building the foundation for his future entrepreneurial ventures.

Founding and Growth of Och-Ziff Capital Management

After 11 years at Goldman Sachs, Daniel Och made a pivotal career move in 1994, venturing out on his own to establish Och-Ziff Capital Management Group. This bold decision marked a turning point in his career, transforming him from a rising star to a leading figure in the hedge fund industry. The initial capital for Och-Ziff was provided by the billionaire Ziff brothers, who invested $100 million in seed money, demonstrating early confidence in Och’s vision and capabilities.

Och-Ziff rapidly gained prominence and expanded its operations. In 2007, the group went public, listing on the New York Stock Exchange with an initial price of $32.00. This IPO was a significant milestone, reflecting the firm’s growing influence and financial success. While the stock price has fluctuated since the IPO, the company has continued to manage substantial assets, underscoring its enduring presence in the market. At its peak in 2015, Och-Ziff managed over $50 billion in assets, highlighting its significant impact on the financial landscape.

The Transformation to Sculptor Capital Management

In a strategic move, Och-Ziff Capital Management Group changed its name to Sculptor Capital Management in September 2019. This rebranding reflected the evolution of the company and its adaptation to the changing dynamics of the financial industry. Today, Sculptor Capital Management continues to trade on the New York Stock Exchange under the symbol SCU, solidifying its position as a publicly traded entity. The firm’s ability to adapt and evolve has been crucial to its long-term success and continued influence in the financial world. Despite some market fluctuations, the company has consistently maintained a substantial amount of assets under management, currently estimated to be around $35 billion.

Getty

Real Estate Ventures and Investments

Daniel Och has also made significant investments in real estate, demonstrating a keen understanding of the property market. In 2019, he made a notable purchase of an apartment in New York City at 220 Central Park South, paying $93 million for the luxurious residence. This acquisition highlighted his interest in high-end real estate. Demonstrating his acumen in the real estate market, Och sold the apartment in January 2022 for a remarkable $190 million, resulting in a profit of nearly $100 million in just over two years. This significant return underscores his strategic approach to real estate investments.

In addition to the sold apartment, Och continues to own a townhouse at 15 Central Park West. He initially listed the property for sale in 2019 with an asking price of $57.5 million, reflecting his portfolio diversification efforts. However, the property was later taken off the market, indicating a potential shift in his real estate strategy. Och’s move to Florida for tax purposes suggests a broader trend of high-net-worth individuals adjusting their asset locations to optimize financial outcomes.

Financial Impact and Legacy

Daniel Och’s career and financial success have made a substantial impact on the financial industry. His founding and leadership of Och-Ziff (now Sculptor Capital Management) have established him as a key player in hedge fund management and alternative asset management. His ability to build and grow a successful firm from the ground up, coupled with strategic real estate investments, showcases his entrepreneurial skills and financial expertise. Och’s legacy will likely be one of innovation, strategic financial management, and significant contributions to the world of finance.