Andrew Carnegie at a Glance

- Categories: Business > Billionaires, Business

- Net Worth: $310 Billion

- Birthdate: Nov 25, 1835 - Aug 11, 1919 (83 years old)

- Birthplace: Dunfermline

- Gender: Male

- Profession: Entrepreneur, Businessperson, Business magnate

- Nationality: United States of America

- Height: 5 ft 2 in (1.6002 m)

Andrew Carnegie: From Humble Beginnings to Billionaire Philanthropist

What was Andrew Carnegie’s Net Worth?

Andrew Carnegie, a name synonymous with American industrial might and unprecedented philanthropy, left an indelible mark on the 19th and early 20th centuries. Born in Scotland and later immigrating to the United States, Carnegie spearheaded the remarkable expansion of the American steel industry. His acumen for business, coupled with his commitment to giving back, transformed him into one of the wealthiest and most influential individuals in history. At his peak, adjusted for inflation, Andrew Carnegie’s net worth reached an astounding $310 billion. This colossal fortune positioned him as the fourth richest person of all time, a testament to his extraordinary success. However, the story of Andrew Carnegie is not just about wealth; it is also a narrative of profound generosity. Throughout his life, he donated over 90% of his vast fortune to a myriad of foundations, charities, and organizations, embodying a philosophy of giving that continues to inspire.

Carnegie’s leadership in the steel industry was marked by two significant innovations: mass production through the adoption and adaptation of the Bessemer process, which significantly reduced the cost of steel production, and vertical integration of steel production, where he controlled all aspects of the steel-making process from raw materials to finished products. At his zenith, Carnegie’s control over integrated iron and steel operations in the United States was unparalleled.

In a pivotal move in 1901, Carnegie sold his Pittsburgh-based Carnegie Steel Company to J.P. Morgan for $303 million. Carnegie’s personal share from this sale amounted to $225 million, which is equivalent to roughly $7 billion in today’s dollars. The final sum eventually reached $480 million due to the interest earned on the bonds that Morgan used to finance the transaction. This staggering wealth, especially when viewed in relation to the U.S. GDP at the time, underscored the magnitude of Carnegie’s financial prowess. Modern estimates place his current-day equivalent net worth in the range of $300-$310 billion. Following the acquisition, the newly named U.S. Steel Corporation quickly became the first company in U.S. history to surpass a market capitalization of $1 billion. Carnegie then dedicated the remainder of his life to extensive philanthropy, focusing on endeavors such as the establishment of local libraries, the promotion of world peace, the advancement of education, and the support of scientific research.

Prior to his passing, Carnegie had already given away more than $350 million of his personal fortune. At the end of his life, his remaining $30 million was distributed to various foundations, charitable causes, and to provide for pensioners.

.cnw_key_facts-widget{margin:0 0 1.25em 0;position:relative}.cnw_key_facts-widget:before{content:”;border-top:2px solid #008080;border-left:2px solid #008080;display:inline-block;width:12rem;height:3.25rem;position:absolute}.cnw_key_facts-widget:after{content:”;border-bottom:2px solid #008080;border-right:2px solid #008080;display:inline-block;width:12rem;height:3.25rem;position:absolute;bottom:0;right:0}.cnw_key_facts-widget .cnw_key_facts-header{text-transform:uppercase;letter-spacing: .05rem;font-family:Oxygen,Georgia,Arial;font-weight:bold;font-size:1rem;margin-bottom:0;display:block;padding:1.5625rem 1.25rem .5625rem}.cnw_key_facts-widget .cnw_key_facts-data{padding:0 1.25rem 1.25rem 1.25rem}@media screen and (max-width: 480px){.cnw_key_facts-widget:before{width:7rem;height:1.75rem}.cnw_key_facts-widget:after{width:7rem;height:1.75rem}.cnw_key_facts-widget .cnw_key_facts-header{padding:1rem 1rem 0.5rem 1rem}.cnw_key_facts-widget .cnw_key_facts-data{padding:0 0.5rem 1rem 0.5rem}.cnw_key_facts-widget .cnw_key_facts-data ul, .cnw_key_facts-widget .cnw_key_facts-data ol{margin-bottom:0 !important}.cnw_key_facts-widget .cnw_key_facts-data li:last-child{margin-bottom:0}}

Early Life: The Seeds of Ambition

Andrew Carnegie’s journey began on November 25, 1835, in Dunfermline, Scotland. Born to Margaret and William Carnegie, he was raised in a modest, two-room cottage. His father, a weaver of fine cloths, used the first floor as his workshop, while the family lived in a single room on the upper floor. To supplement the family income, Margaret Carnegie sold potted meats. Faced with economic hardship, the family made the difficult decision to immigrate to the United States in 1848, after borrowing money from Margaret’s brother, George Lauder, Sr.

Upon arriving in the United States, Carnegie took on several jobs. He began as a bobbin boy in a cotton mill and later became a telegraph messenger boy at the Pittsburgh office of the Ohio Telegraph Company. His career trajectory took a significant turn when he joined the Pennsylvania Railroad Company at 18. His strong work ethic and managerial skills quickly came to the attention of his superiors, and he was soon promoted to superintendent of the Western Division. The connections he cultivated in the railroad industry proved invaluable later in his career, as he met numerous future investors and honed his management expertise.

A pivotal moment in his early career was the receipt of his first dividend check in 1866, for $10. Reflecting on this experience, the 21-year-old Carnegie stated:

“It gave me the first penny of revenue from capital – something I had not worked for with the sweat of my brow. Eureka! Here’s the goose that lays the Golden eggs!“

The income from dividend checks and interest payments propelled the young Carnegie to millionaire status before he turned 40.

Professional Pursuits: Building an Empire

During the early years of the Civil War, Carnegie received a deferment from the draft because his work for the Pennsylvania Railroad was considered essential to the war effort. Pennsylvania’s production of munitions, building materials, and coal was critical to the Union army’s supply lines, and the state’s railroads served as vital transportation arteries for both goods and troops. Though his deferment eventually expired, Carnegie was able to pay an Irish immigrant $750 to serve in his place. This practice was not illegal at the time and was a common practice among wealthy industrialists.

After the war, Carnegie continued to hone his skills as a manager and investor. He facilitated a merger between a sleeping car company and the inventor of a sleeping car designed for first-class travel, a deal that benefited all parties involved.

Carnegie’s business acumen and reputation attracted lucrative opportunities. He was often sought out as a partner in new ventures, rather than a competitor. This was in part due to the success he had in the pre-steel era, where he often combined business interests with related industries, sometimes employing practices that skirted ethical boundaries. For instance, he held a majority stake in an ironworks company that became the primary supplier of iron to the railroad in which he was a major investor. He also capitalized on inside information about the planned routes of railroads to acquire real estate in areas where future towns would inevitably emerge. These practices, while not considered illegal until 1934, demonstrate the aggressive, yet accepted, business environment of the 1860s and 1870s. Carnegie embraced this strategy, reaching remarkable heights.

In 1867, he established the Keystone Telegraph Company, assigning himself majority ownership and distributing small percentages to partners. He arbitrarily valued the company at $50,000, despite it having no assets or existing contracts at its formation. Soon after, the company secured a contract from the Pennsylvania Railroad, where Carnegie was a key investor, to lay telegraph lines. Six months later, even before any lines had been laid, Carnegie sold the Keystone Telegraph Company to the Pacific & Atlantic Telegraph Company for 6,000 shares of its stock. At the time, the shares were worth $150,000, a threefold return in six months. Within a few years, his former Pennsylvania Railroad partners took control of P&A Telegraph, and Carnegie was paid in shares of Western Union. He maintained these Western Union shares for the rest of his life, receiving substantial annual dividends.

By the early 1870s, Carnegie’s principal business interests comprised:

- 40% ownership of Union Iron Mills (also known as Carnegie, Kloman & Co)

- 20% ownership of Keystone Bridge Company

- 40% ownership of a furnace company named Lucy

- Significant holdings in several publicly-traded railroad companies, including the Pennsylvania Railroad

To raise capital for his ventures, Carnegie frequently traveled to Europe to sell bonds. When not involved in bond sales, he contended with shortages in iron and steel supply, which often made the construction of bridges and railroads particularly challenging.

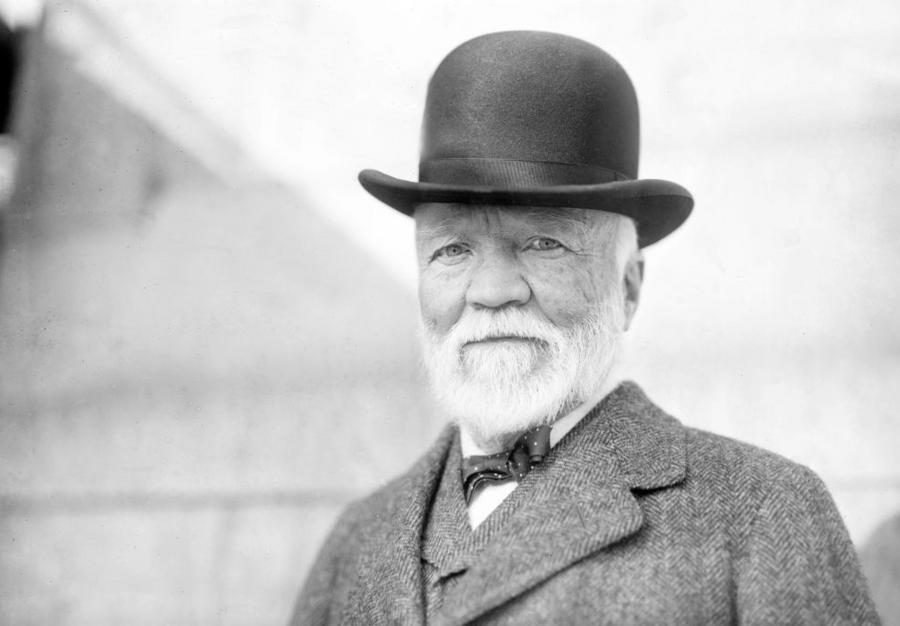

(Photo by APIC/Getty Images)

The Rise of Steel: Carnegie’s Industrial Revolution

Carnegie’s focus soon shifted from the railroad industry to ironworks and, eventually, to steel, which would be the industry in which he would build his monumental fortune. His influence on the steel industry was transformative, significantly accelerating the growth of U.S. steel production, surpassing that of the United Kingdom. Two crucial factors were instrumental in this rapid expansion: Carnegie’s strategic adoption of the Bessemer process, leading to a significant reduction in steel prices, and the vertical integration of the steel industry, where he controlled all aspects of production. Carnegie strategically established control over all the raw materials needed for steel production, acquiring rival companies to build the Carnegie Steel Company.

The Sale to J.P Morgan: Cashing Out and Giving Back

As Carnegie neared his retirement in the early 1900s, Charles M. Schwab, an executive at Carnegie Steel, began secretly negotiating with financier John Pierpont Morgan, also known as J.P. Morgan, to sell the company. Though Schwab is not related to the modern financier Charles Schwab, the bank J.P. Morgan is indeed directly linked to the financier. A deal was eventually agreed upon where Carnegie Steel was sold to Morgan for $303 million, with Carnegie’s share exceeding $225 million. The resulting company, managed by Schwab, was named the United States Steel Corporation. J.P. Morgan, however, did not have $303 million in cash. Instead, the payment was made with physical bonds that paid a 5% annual interest over a 50-year period. These bonds were stored in a custom-built vault at a bank in Hoboken, New Jersey. Including the interest, the total cost of the acquisition eventually reached $480 million.

One of Carnegie’s first acts after the sale was to allocate $5 million to fully fund a pension for his steel workers.

A Legacy of Giving: Carnegie’s Philanthropic and Scholarly Pursuits

Throughout his career, Carnegie also devoted himself to writing and philanthropy. He contributed funds towards the establishment of the Dunfermline Carnegie Library in his hometown in Scotland and assisted in creating what is now the Carnegie Laboratory at NYU. Additionally, he was a frequent contributor to various magazines, including “The Nineteenth Century” and “North American Review.”

Carnegie also authored several books, notably “Triumphant Democracy” and “Wealth.” In these publications, he wrote extensively about the American system of government and his views on the responsibilities of the wealthy in the allocation of their wealth.

Upon retirement, Carnegie became a full-time philanthropist. He was instrumental in establishing the public library system in the U.S., Canada, and other English-speaking countries, helping to fund and build over 3,000 libraries.

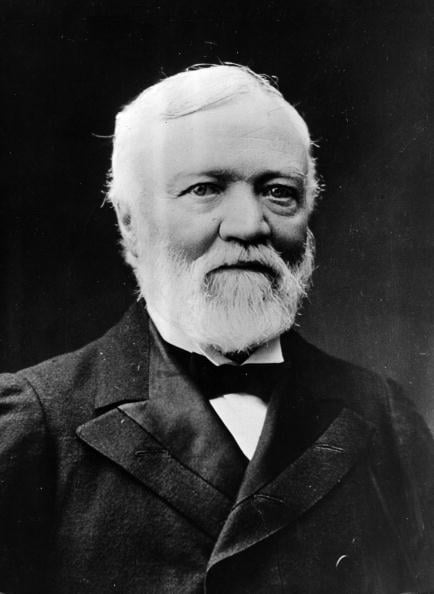

Getty Images

He was also a strong advocate for education, investing heavily in universities, research centers, and other educational organizations both in the United States and abroad. He donated $10 million to George Ellery Hale to assist in the construction of the 100-inch Hooker telescope at Mount Wilson, a project that proved successful. He also created the Carnegie Trust for the Universities of Scotland, with the aim of improving scientific research opportunities at Scottish universities. Carnegie also supported Booker T. Washington’s efforts to advance education for African-Americans, helping him establish the National Negro Business League.

In addition to his focus on education, Carnegie was also deeply interested in music. He personally funded the construction of Carnegie Hall in New York City, as well as the building of over 7,000 church organs around the world.

Personal Life: Family and Later Years

At age 51, Carnegie married Louise Whitfield, who was 30 at the time. The couple married in New York City and had their only child, a daughter named Margaret, ten years later. Carnegie died in 1919 in Massachusetts from bronchial pneumonia.

Legacy: Enduring Impact on the World

Andrew Carnegie’s influence continues to resonate through the many foundations, organizations, universities, and charities that he either founded or significantly supported. By the time of his death, he had given away over $350 million, with the remainder of his estate donated after his passing. Some of Carnegie’s most enduring legacies include Carnegie Mellon University in Pittsburgh, originally established as the Carnegie Technical Schools, the Carnegie Corporation of New York, The Carnegie Foundation for the Advancement of Teaching, and the Carnegie Endowment for International Peace. In addition, a number of streets, towns, and awards bear his name, including the Carnegie Medal, a UK children’s literary award, the towns of Carnegie, Oklahoma, and Carnegie, Pennsylvania, and Carnegie Hall in New York City.

/**/