C. Dean Metropoulos at a Glance

- Categories: Business > Billionaires, Business

- Net Worth: $2.3 Billion

C. Dean Metropoulos’s Net Worth: A Billionaire’s Business Empire

Introduction: The Billionaire Behind the Brands

C. Dean Metropoulos is an American businessman renowned for his astute investments and successful turnarounds of iconic brands. With a net worth of $2.3 billion, he stands as one of the wealthiest individuals in Connecticut. His investment firm, Metropoulos & Co., has orchestrated over 80 acquisitions, revitalizing well-known companies and leaving a significant mark on the food, beverage, and consumer products sectors. This article delves into the life, career, and achievements of C. Dean Metropoulos, exploring how he built his fortune and continues to influence the business landscape.

Early Life and Education: Roots in Greece and a Foundation in Business

Born in Tripoli, Greece, in May 1946, C. Dean Metropoulos immigrated to the United States with his family at the age of ten, settling in Watertown, Massachusetts. His early life in America laid the groundwork for his future success. Metropoulos pursued higher education at Babson College in Wellesley, Massachusetts, where he earned both his Bachelor’s degree and his Master of Business Administration (MBA). These academic credentials provided a solid foundation for his career in business and finance.

Career Beginnings: From Financial Director to Private Equity Pioneer

Metropoulos’s professional journey began at the age of 25 when he relocated to Geneva, Switzerland, to serve as a financial director for GTE International. His tenure at GTE marked the start of a successful corporate career. He eventually rose to the position of senior vice president at GTE and returned to the United States as the company’s youngest controller, showcasing his rapid advancement and growing expertise in financial management and leadership.

Metropoulos & Co.: Building a Diversified Investment Powerhouse

After accumulating substantial wealth in private equity during the 1970s and 1980s, Metropoulos founded Metropoulos & Co. in 1993. Headquartered in Greenwich, Connecticut, the investment firm focuses on acquisitions within the food and beverage, consumer products, and other diversified sectors. The company’s portfolio boasts an impressive track record of over 80 acquisitions, including such prominent brands as Hostess Brands, Aurora Foods, Stella Foods, BlueTriton, Ghirardelli, Morton Salt, and Briggs & Stratton. As chairman and CEO, C. Dean Metropoulos leads the firm alongside his sons, Evan and Daren.

- Hostess Brands: A major acquisition that revitalized a classic American brand.

- Pabst Brewing Company: A significant investment that led to increased popularity.

- Aurora Foods: Revitalized through strategic mergers.

The Pabst Brewing Company: A Strategic Acquisition and Resounding Success

One of Metropoulos & Co.’s most notable acquisitions was the Pabst Brewing Company, purchased in 2010 for approximately $250 million. Under Metropoulos’s leadership, Pabst experienced a resurgence in popularity, both domestically and internationally. The firm’s ownership included the distribution rights to several other beer brands, such as Schlitz, Schaefer, and Falstaff. In 2014, the Metropoulos family sold Pabst to entrepreneur Eugene Kashper for around $700 million, who then completed the sale to Blue Ribbon, a partnership between himself and the private equity firm TSG Consumer Partners. This transaction highlighted Metropoulos’s ability to identify undervalued assets and significantly increase their market value.

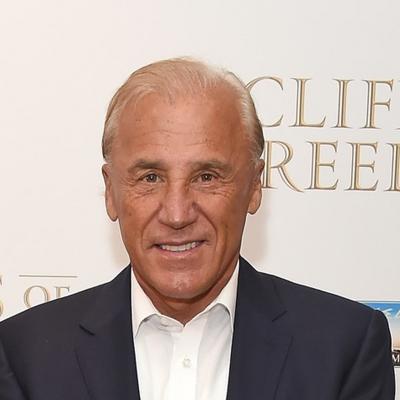

Marianne and Dean Metropoulos (Photo by David M. Benett/Getty Images)

Personal Life and Family: Sons in Business and a Legacy of Success

C. Dean Metropoulos and his wife, Marianne, have two sons, Evan and Daren, who are actively involved in the family business. Marianne Metropoulos previously served as the president of Aegean Entertainment, a movie production company. The family resides in Palm Beach, Florida. Both Evan and Daren contribute significantly to Metropoulos & Co., specializing in operational and marketing strategies. They also pursue independent ventures, with Daren notably purchasing the Playboy Mansion in 2016 for $110 million after acquiring the property next door. Both sons are also involved in the luxury residential real estate sector, continuing the family’s legacy of successful business ventures.

Key aspects of the family’s involvement include:

- Daren Metropoulos: Known for managing and renovating the historic Castle on the Hudson and purchasing the Playboy Mansion.

- Evan Metropoulos: Collaborates with Daren in various business endeavors.

- Marianne Metropoulos: Previously led Aegean Entertainment.

Conclusion: Metropoulos’s Enduring Impact on Business and Beyond

C. Dean Metropoulos’s career exemplifies strategic investment, astute business acumen, and a knack for revitalizing iconic brands. Through Metropoulos & Co., he has not only amassed significant wealth but has also left a lasting impact on the consumer market. His legacy is one of shrewd acquisitions, successful turnarounds, and a family deeply rooted in business and innovation. From his early days in Greece to his current status as a billionaire, Metropoulos’s journey provides valuable insights into the world of private equity and the enduring power of smart business decisions.